is there real estate transfer tax in florida

If passed this new transfer tax would be 20 for amounts over 2. Real Estate Transfer Tax Florida imposes a transfer tax on the transfer of real property in Florida.

Real Estate Transfer Taxes Deeds Com

Does Florida have real estate transfer tax.

. In every county except Miami-Dade the Florida transfer tax is 07 of the purchase price of the home. For example if you borrowed 100000 to purchase your property your mortgage transfer tax. Unlike property taxes and mortgage interest you canât reduce your tax bill by deducting transfer tax.

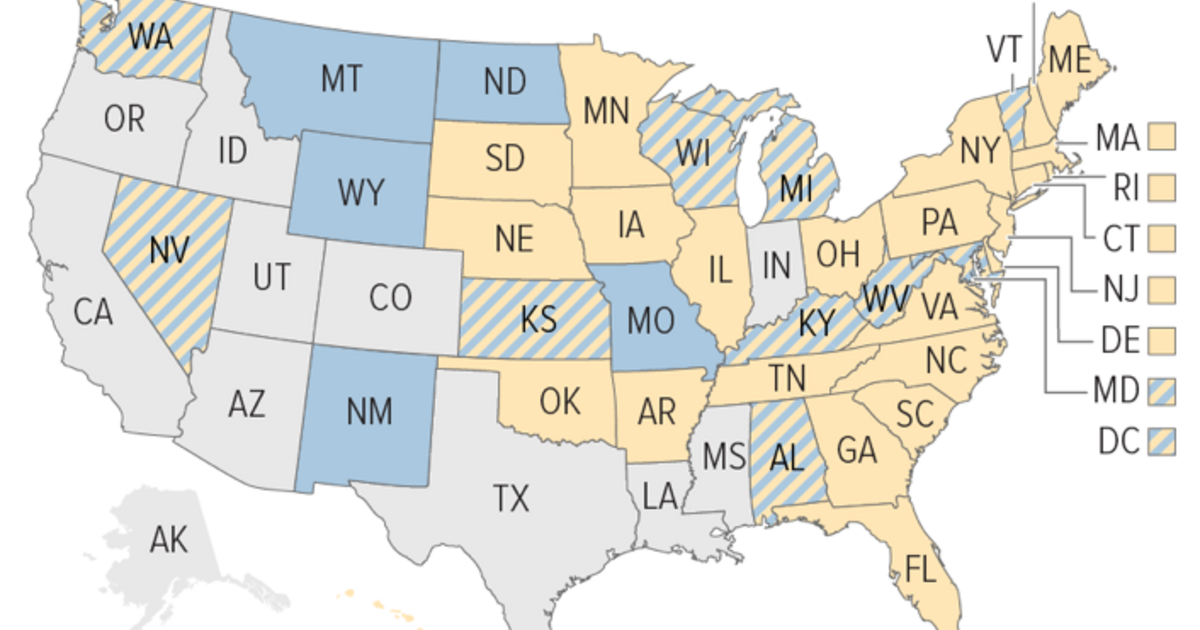

The tax rate for documents that transfer an interest in real property is. The Florida real estate transfer tax varies depending on the county. The District of Columbia reduces its deed recordation tax for first-time homebuyers to 0725 for values up to 400000.

This exemption qualifies the home for the Save Our Homes assessment limitation. For the purposes of determining. The short answer is no real estate transfer taxes are not tax-deductible.

This tax is normally paid at closing to the Clerk of. An inheritance tax also called an estate tax is a tax based on the wealth of a deceased person. Since there is no other consideration for the transfer.

Florida does not have an inheritance tax so Floridas inheritance tax rate is. While the exemption is nontransferable a homeowner may be able to transfer or port all or part of the. In Florida transfer tax is called a documentary.

The tax is called documentary stamp tax and is an excise tax on the deed. Documents that transfer an interest in. For example if a property is purchased for 200000 first divide the sales price by 100 then multiply by 70 for a total of.

The state of Florida commonly refers to transfer tax as documentary stamp tax. In Florida real estate transfer taxes also known as a stamp tax or doc stamp are imposed on the transfer of any residential and commercial property and any written obligation to repay the. The rate is equal to 70 cents per 100 of the deeds consideration.

Documentary stamp tax is an excise tax imposed on certain documents executed delivered or recorded in Florida. The transfer tax in Florida is levied at 70 cents for each 100 of consideration for most recorded documents including deeds of conveyance. Florida also charges a transfer tax of 055 based on the mortgage amount balance.

70 per 100 or portion thereof of the total consideration paid or. What are transfer taxes in Florida. The most common examples are.

Free Real Estate Purchase Agreement Rocket Lawyer

Florida Agreement For The Purchase And Sale Of Real Estate Transfer Of Title From One Joint Owner To Other Joint Owner Florida Purchase Sale Real Estate Us Legal Forms

South Carolina Real Estate Transfer Taxes An In Depth Guide

Sales Taxes In The United States Wikipedia

Nyc Nys Transfer Tax Calculator For Sellers Hauseit

/arc-anglerfish-arc2-prod-pmn.s3.amazonaws.com/public/URGPECSXRNDTNFO3IH6EIDFN64.jpg)

Philly Misses Full Bounty Of Shops At Schmidts Sale As Transfer Tax Shortfalls Persist

2022 Real Estate License Reciprocity Chart Portability Guide 2022 Updated

Alabama Real Estate Transfer Taxes An In Depth Guide

Florida Real Estate How Much Will It Cost Nmb Florida Realty

When Are Beneficiaries In Florida Liable For Inheritance Tax Deloach Hofstra Cavonis P A

Free Florida General Warranty Deed Form Pdf Word Eforms

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

Florida Intangible Tax And Transfer Tax How Do You Calculate These Closing Costs Usda Loan Pro

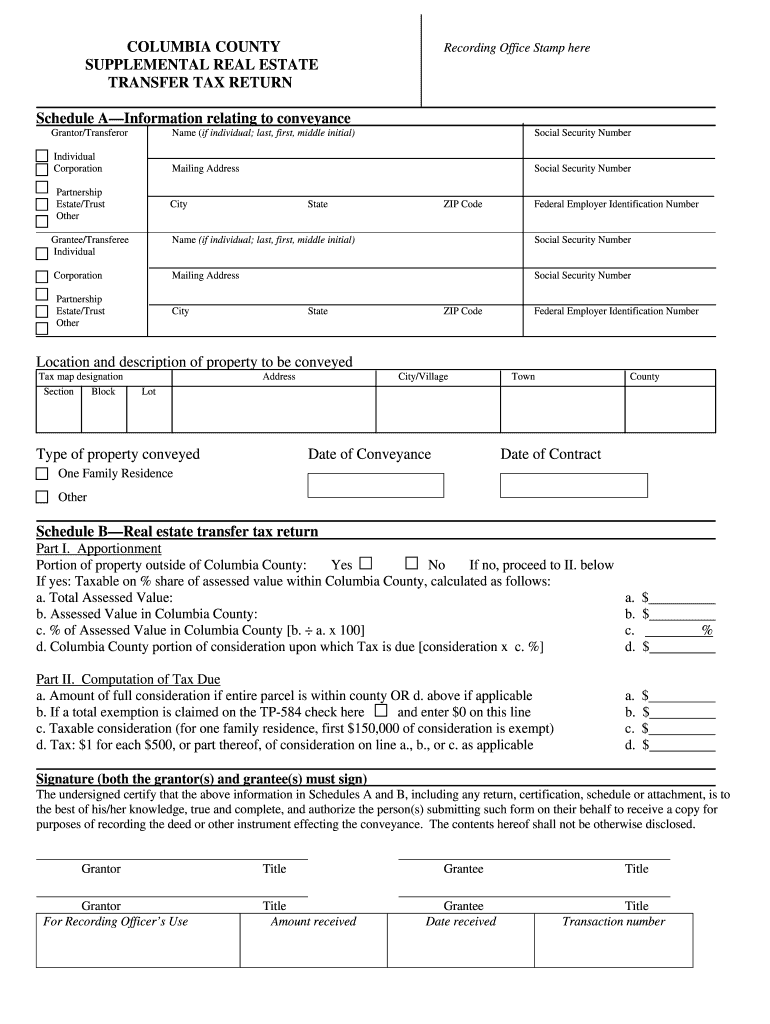

Combined Real Estate Transfer Tax Return Form Free Download

Sales Taxes In The United States Wikipedia

Transfer Tax Calculator 2022 For All 50 States

Ny Supplemental Real Estate Transfer Tax Return Fill Out Tax Template Online Us Legal Forms

After Car Owner Dies How To Transfer Title

Bipartisan Bill Would Cut Realty Transfer Tax By 25 Town Square Delaware Live